about company

Baoxin Creditor's Rights Asset Management Co., LTD's Vision is:

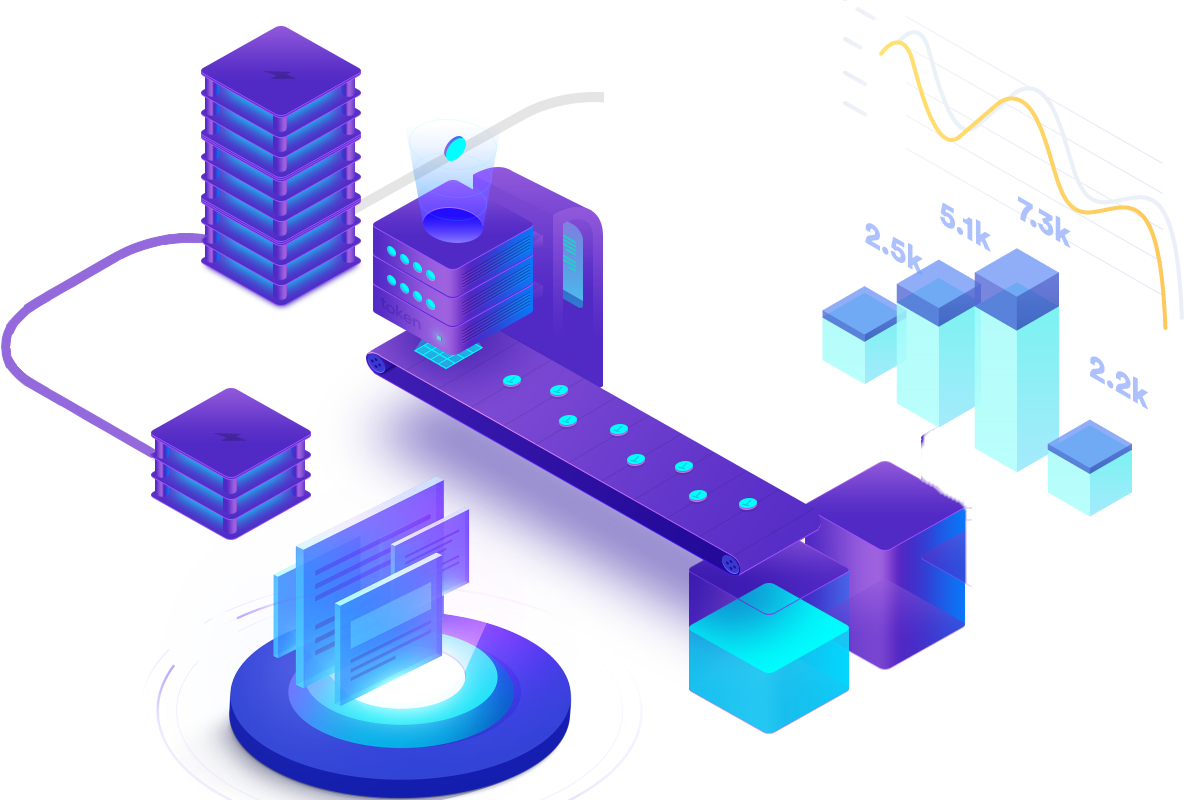

To become the leading provider of digital assets tokenization services in Hong Kong and globally, supporting the transition of HKDB to a stable and secure digital asset platform.

White Paper PDF80+

Total Transition

To create a stable and secure digital asset platform, HKDB, supporting the transition of HKDB to a stable and secure digital asset platform.

185+

Deals

Promote the integration of debt finance and Web3

173+

Sites

To provide long-term, sustainable value returns to investors, financial institutions, and ecosystem participants.

45 Years

Bank & Finance Service